Solutions

Strategic Advisory Services

Key financial data is fundamental to our insights.

Information is power, when it comes to identifying and assessing the potential of companies.

The most reliable research depends upon access to verifiable financial analytics.

Our expertise, including analytics and understanding of impactful macroeconomic factors,

can be leveraged by institutions and companies to assist in strategic decisions.

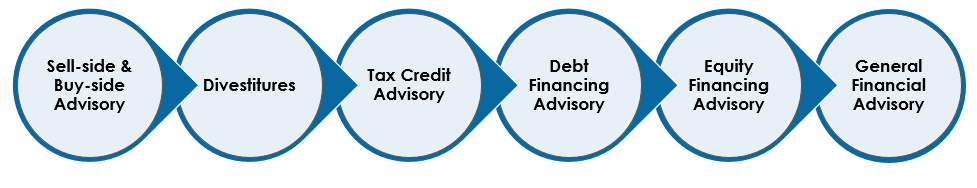

Capital Raising

Birling supports clients in evaluating their short-term and long-term capital requirements. We advise clients in securing financing to accommodate their most critical strategic growth and recapitalization initiatives, including business acquisitions, shareholder buyouts, working capital needs, and other crucial growth activities. Our partners are experts at assisting clients in securing financing from private investors through the issuance of debt or equity and obtaining senior debt, mezzanine, and equity financing from institutional lenders and private equity groups.

Expertise

Strategic Advisory Services

Key financial data is fundamental to our insights. Information is power, when it comes to identifying and assessing the potential of companies. The most reliable research depends upon access to verifiable financial analytics. Our expertise, including analytics and understanding of impactful macroeconomic factors, can be leveraged by institutions and companies to assist in strategic decisions.

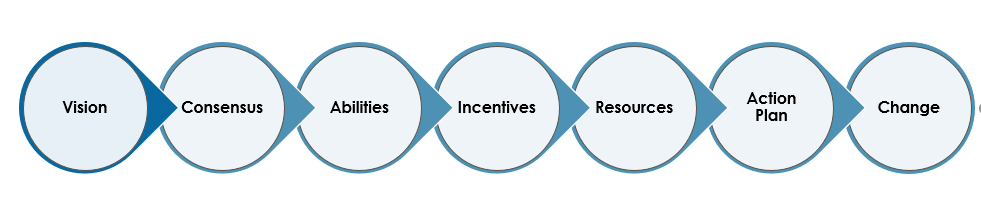

Managing the power of Change

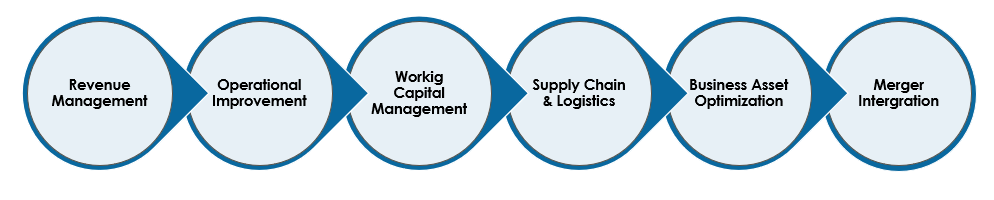

Performance Improvement

Birling sets the basis to improve the efficiency and effectiveness of clients’ operations with a balanced approach, focused on increasing revenues and cutting costs. We help clients align business activities to a “core” priorities and develop a balance between short-term and long-term goals. Using external metrics and deploying best practices, we accelerate clients’ growth and increase effectiveness. Our systemic changes lead to sustainable results.

MERGERS AND ACQUISITIONS

Birling assists clients in developing and executing value-maximizing merger and acquisition strategies. We advise corporate, middle-market and family companies on sell-side and buy-side M&A advisory assignments, as well as corporate carve-outs and divestitures. We leverage our industry expertise, operational insight, and transaction execution proficiency to help clients understand their strategic alternatives, assess their business positioning, and navigate the complexities of the M&A process. Through years of dedication to specific markets and their constituent stakeholders, our access to acquirers and investors within the corporate, middle-market and family corporations provides a value added proposition to our clients.

Valuation

Birling leverages its deep knowledge of market dynamics and relevant industry trends to provide corporations, business owners, and investors with insightful valuation advice and guidance. Birling believes that every corporation should understand its current value as well as those areas that reduce the value of a going concern.

- Income Approach

- Market Approach

- Net Asset Approach

Tax Credit Advisory and Consulting

Birling leverages its deep knowledge of market dynamics and relevant industry trends to provide

advice to clients in the United States and Puerto Rico to assist them in developing effective

tax planning strategies that will minimize the tax costs of doing business in Puerto Rico.

Our team has advised clients in connection with:

- Act No. 73 Economic Development Incentives Act

- Act No. 20 Export Service Promotion Act

- Act No. 22 Individual Investors Act

- Act No. 27 Film Industry Economic Incentives Act

- Act No. 83 Green Energy Incentives Act

- Act No. 74 Tourism Development Act

Working with all of Puerto Rico’s tax credit and tax incentives programs. We have successfully

negotiated and monetized multiple tax credits.

During the 2018 YTD we have advised in excess on $35mm.

Board Of Directors Advice

Strong corporate governance is becoming increasingly important, especially with corporations facing a significant increase in regulatory scrutiny and raised expectations regarding risk management.

Board Effectiveness

We help boards run smoothly and effectively. Our Advisory consultants provide services to boards on areas such as strategic alignment among the board and management, board culture, director effectiveness and engagement, board and committee processes and structure.

Board Culture and Performance

We help companies shape their culture for better performance. We believe that the culture and chemistry of a board are directly linked to its effectiveness. We work closely with boards to define and shape a culture that ensures the board is performing at a high level and directors are fully contributing.

Corporate governance for family-controlled firms.

Advisory consultants partner with family firms in their journey starting with hiring an independent directors and committee chairman.

Promesa Group

Birling Capital is active in all developments in Puerto Rico related to PROMESA and has organized

the 1st PROMESA Conference with the Puerto Rico Chamber of Commerce. In addition, it regularly

serves on panels throughout Puerto Rico and Stateside on different aspects relating to PROMESA.

The Puerto Rico Oversight, Management and Economic Stability Act (PROMESA) was enacted as a

broad federal law designed to bring fiscal stability to the Puerto Rican economy and provide for

the oversight of budgetary and fiscal policies for at least the next five years.

PROMESA is intended to provide a method for Puerto Rico to achieve fiscal responsibility

and access to the capital markets. PROMESA creates and appoints an Oversight Board to supervise

Puerto Rico’s central government, its instrumentalities’ budgets and fiscal policies and directs

and manages the restructuring of their obligations through out-of-court negotiations, or court

proceedings that incorporate concepts from the federal Bankruptcy Code. PROMESA also appoints a

revitalization coordinator, and includes provisions that overhaul the process for the review and

permitting of certain infrastructure projects within Puerto Rico.

PROMESA also imposes an “automatic stay” effective immediately, creates a U.S. Congressional

Task Force for the economic growth of Puerto Rico, and requires certain reporting and analysis on

Puerto Rico’s debt and pension plan systems. In sum, PROMESA’s reach is likely to impact

significantly on a wide range of contracts, transactions and governmental decisions for at least

the next five years.

Our deep knowledge of the capital markets combined with our multi-disciplinary team comprised

of members from our Corporate Advisory, Financial Institutions, Restructuring, Mergers and

Acquisitions, Public Private Partnerships, Government and Board of Directors Advice Groups enables

us to follow the developments with respect to PROMESA closely. We are prepared to assist clients

to plan for and navigate the complexities of the new law, and to help identify the business

opportunities and challenges that will arise as the Oversight Board and the Task Force propose

new directions and strategies for the fiscal stability of the government and the growth of the

economy of the Commonwealth of Puerto Rico.